When trading the financial markets, most of the time simple things work better than more elaborated systems. Nowadays, thanks to AI applied to markets, we can train simple systems to give us a good statistical probability of success when trading an index.

Some years ago I created a simple logistic regression in order to forecast whether the European index is going to be positive or negative during its trading hours, from open to close. The principle of the logistic regression model is to explain the occurrence or not of an event (being todays return positive or negative) by the level of explanatory variables (say past returns of the index itself and other indexes).

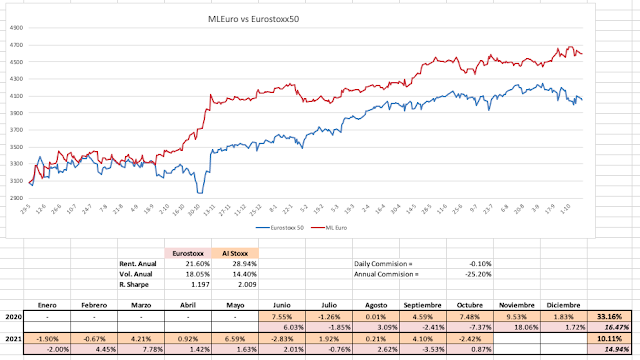

After a very good out-of-sample results, I decided to start trading the system with CFDs on the Eurostoxx 50 in order to test it with a small account.

Obviously, trading costs are to high in this context since I am trading a single contract with a nominal of around 4000 Euros, and a trading cost 2€ to enter the position and 2€ to exit it at the end of the day; it is a trading cost of -0.10% daily which means more than -25% trading costs annually. Therefore, improvements can be done if we have a larger account or using futures.

Nevertheless, results have been quite good so far. Since real trading started June last year the system has achieved a +28.94% return versus +21.6% of the Eurostoxx 50. Even more, volatility has been much lower, which give us a Sharpe Ratio higher than 2 from June last year till yesterday.

What do you think?