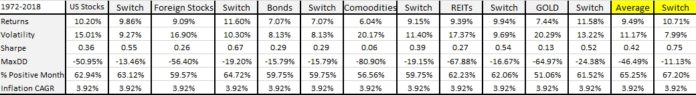

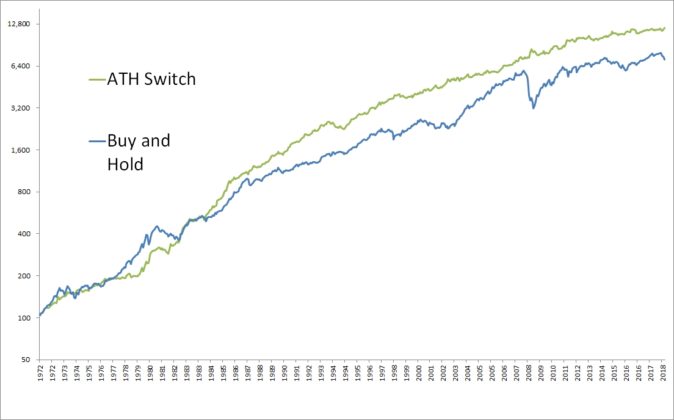

Recently, I was a looking at 2019 article from Meb Faber where he points out how GREAT has been to buy stocks at an all-time high. He did a study all the way back to the 1920s where he rebalances a monthly portfolio that is invested in Stocks if stocks closed the previous month at all time high, and if not, the portfolio is invested in bonds. The results below are taken from his post; the average portfolio is an equal weight across US stocks, foreign stocks, real estate, commodities and gold:

As an European investor, I wanted to see if that would have worked in the European markets. Therefore, I looked to apply the same logic to five of the main European indexes (Eurostoxx 50, CAC 40, FTSE MIB, Ibex 35 and Dax 30) as «stocks» and the SPDR Bloomberg Barclays Euro Government Bond ETF as «bonds». I used data for the last 10 years since it is when the ETF started to trade.

To all but the Dax 30 Index, we would have been invested in the «bonds» ETF for the whole period, since none of them have made new highs in the las 10 years. In the case of the Dax 30, the chart shows as follows:

As we see, following the strategy in these European indexes gave us the same return as being invested in bonds (even less in the case of the Dax 30).

After all these results, to main concerns come to my mind:

- On the one hand, probably, the previous study was done for a long period where returns in the bond markets have been extraordinary goods. Nowadays, and in the last years, we are in a period where bonds’ yields are at their lowest point in recent history, and probably returns in the bond markets are not going to be as they were in previous decades.

- On the other hand, this points out why European investor should look to invest in the different markets. Home bias is dangerous tendency for investors to invest the majority of their portfolio in domestic equities.

Being local does not pay when investing… at least last ten years.